Credit transfers

Transfer money between accounts around the world, whether in euros or multiple currencies.

Types of credit transfers

Swan offers two main types of credit transfers. Each type has its own rules, capabilities, and APIs.

Refer to the dedicated sections to understand each type and how they work at Swan:

| Transfer type | Description |

|---|---|

| SEPA Credit Transfers | Send and receive money using euro-based accounts and the SEPA network Includes:

|

| International Credit Transfers | Send and receive money from around the world in over 40 currencies using local payment rails and SWIFT |

Credit transfer statuses

There's a close link between transaction statuses and account balances. Refer to explanations of types of account balances in the accounts section.

| Transfer transaction status | Explanation |

|---|---|

Upcoming | Transfers are initiated and consent was granted, but the transfers aren't executed yet. Often, this is because the transfer was planned for a future date using the requestedExecutionAt input. Upcoming transfers don't impact the account balance.International Credit Transfers can't be Upcoming |

Pending | Transfers are initiated, consent was granted, and the transfer is set to happen within a few days. The transfers aren't debited from the account yet, but they impact the account's Pending balance.Sometimes, transfers might stay Pending for longer than expected. This could be for a few reasons, including the possibility that the transaction required a manual review from Swan, or a SEPA Credit Transfer was initiated on a TARGET closing day. |

Booked | Completed credit transfers that are displayed on the official account statement. These transfers have been debited from the account, and they impact the account's Booked balance. |

Canceled | An Upcoming transaction is canceled by someone with the right to do so, such as the account holder or an account member. Only transfers with the status Upcoming can be Canceled, and Canceled transfers don't impact the account balance. |

Rejected | Declined or refused transfers. For example, the beneficiary account might be closed, or the account's Available balance isn't sufficient to complete the transfer without resulting in a negative balance. |

Statuses for Standing Orders differ from other credit transfers.

Beneficiaries

Add trusted beneficiaries to accounts to facilitate credit transfers. Adding trusted beneficiaries also reduces the risk of sending a transfer to an unintended beneficiary.

You can add trusted beneficiaries with the API, either with a dedicated mutation or when initiating a credit transfer. If you use Swan's Web Banking interface, eligible account members can add trusted beneficiaries from the app. Beneficiaries who aren't added as trusted are referred to as unsaved beneficiaries.

Beneficiaries & membership permissions

How account members can interact with beneficiaries depends on their account membership permissions.

| Permission | Beneficiary interaction |

|---|---|

canViewAccount | View the list of trusted beneficiaries. |

canManageBeneficiaries | Add trusted beneficiaries. |

canInitiatePaymentswith canManageBeneficiaries | Initiate credit transfers to trusted and unsaved beneficiaries. |

canInitiatePaymentswithout canManageBeneficiaries | Initiate credit transfers to trusted beneficiaries only. |

Trusted beneficiary statuses

| Trusted beneficiary status | Explanation |

|---|---|

ConsentPending | An eligible account member added a trusted beneficiary, either directly (with the dedicated mutation or through Web Banking) or when initiating a transfer. To finish adding the trusted beneficiary, an account member with the canManageBeneficiaries permission must consent with Strong Customer Authentication (SCA). |

Enabled | Consent was received to add the trusted beneficiary. Eligible account members can now initiate transfers to this trusted beneficiary. |

Canceled | Consent wasn't received to add the trusted beneficiary, or the trusted beneficiary was removed from the list by an eligible account member. |

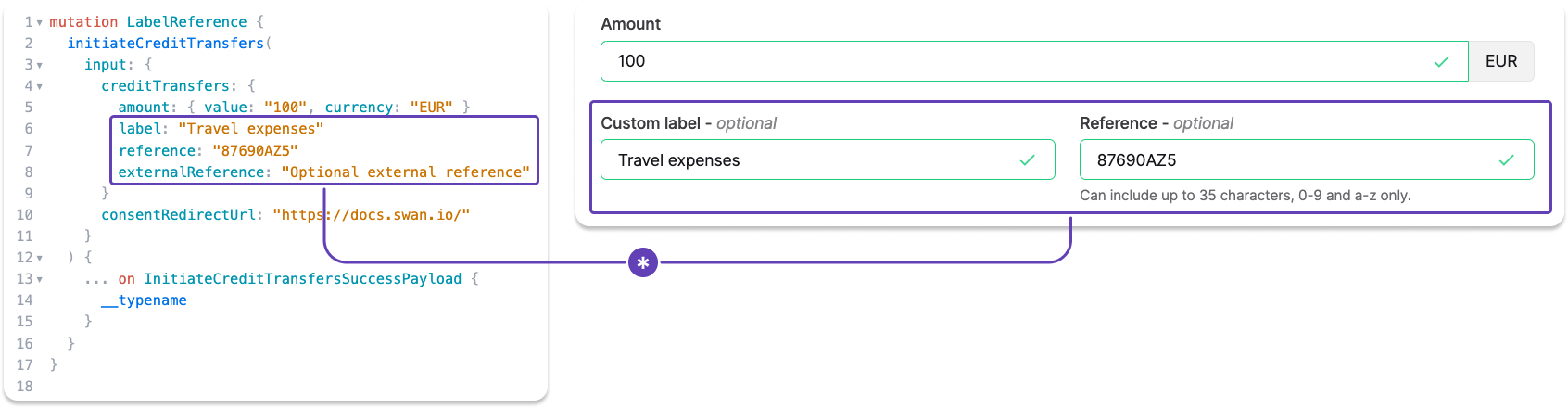

Label and reference

Add custom labels and references numbers to your SEPA and International Credit Transfers with the API, or, if you're using it, Swan's Web Banking interface.

Whether your label and reference entries are visible on other financial institutions' platforms and statements depends on their design.

Custom label

- Optional field where you can name your transaction.

- According to SEPA, this label is for remittance information (

RemittanceInfo), or payment details. - If left empty, the default value for Web Banking is

Transfer to {beneficiary}. However, nothing is sent to the beneficiary's bank. - This value is displayed in your Swan transaction history.

- Your beneficiary probably sees this reference, though it's impossible to know because every app is different.

- Called

labelin the APItransactionobject.

Reference

- Optional field intended to provide a way for you to include a reference number or code.

- According to SEPA, this reference should be used for the end-to-end identification reference (

EndToEndId) used to uniquely identify a transaction from start to finish. - Only characters 0-9 and a-z are allowed in this field. The total number of characters allowed can change, so refer to your transfer form for the character maximum.

- If left empty, there is no default value. Note that the reference field is mandatory for SEPA inter-bank exchanges, so Swan populates an empty field with something similar to your transaction ID.

- This value will be included in the details of a transaction in your transaction history, but not displayed in the main list.

- Your beneficiary probably sees this reference, though it's impossible to know because every app is different.

- Called

referencein the APItransactionobject.

External reference

- With the API, you can also add an external reference.

- Share additional information about a transaction only visible to you.

- Called

externalReferencein the APItransactionobject.