Accounts

Use Swan accounts to receive and initiate payments, as well as deposit money. All money moves through accounts, so if you're using Swan, you're using an account.

Swan accounts are based in euros (€) and are represented by an IBAN and a name.

Get information about the account with the account query, and update information such as the name with the updateAccount mutation.

Accounts, along with account holders, are created during the account onboarding process.

Account country

You choose your account's country during the onboarding process.

The account country then determines IBAN country codes.

For example, consider the sample mutation to create an individual onboarding link.

The account country chosen on line 4 is France (accountCountry: FRA).

All IBANs associated with this account have the prefix FR.

Swan offers the following account countries:

- 🇫🇷 France

- 🇩🇪 Germany

- 🇮🇹 Italy

- 🇳🇱 Netherlands

- 🇪🇸 Spain

Resident and non-resident accounts

The account country isn't always the country where the account holder resides. Your users can have a Swan account if they live anywhere in the European Union, as Swan allows accounts for both residents and non-residents of supported account countries.

- Resident account: The account holder lives in the account country.

- Non-resident account: The account holder lives outside the account country. These accounts often require reporting as a foreign account to the account holder's local tax authority.

Opening accounts is subject to a thorough verification, regardless of residence or account country.

Account language

Account holders choose their account language during onboarding. You can also set the account language when creating onboarding links for individuals and companies.

Swan uses the account language for all official documents and communications.

After an account is created, you can change the account language with the updateAccount mutation.

If you use Swan's Web Banking interface, account holders can change their account language independently.

By default, account memberships inherit the same language as the account. If account members choose a different preferred language than the account holder, however, they receive certain communications in their account membership language.

Supported languages

Several account languages are available:

- Dutch (

nl) - English (

en) - Finnish (

fi) - French (

fr) - German (

de) - Italian (

it) - Portuguese (

pt) - Spanish (

es)

fi)Finnish is a supported account language and account membership language with certain limitations:

- Finnish isn't available as a card language. When the account language is Finnish, the card language defaults to English, which includes card packaging and the language displayed on payment terminals.

- Finnish isn't available for the bank details document. When the account language is Finnish, the bank details document is generated in English.

Account type and level

Swan accounts are defined by a payment level and payment account type. There are two possible values for each:

PaymentLevel→LimitedandUnlimitedPaymentAccountType→EMoneyandPaymentService

Accounts start with the level Limited and the account type EMoney.

The level changes from Limited to Unlimited when the account holder verification status changes to Verified.

The account type changes from EMoney to PaymentService when the account's main IBAN is available to the account holder.

Accounts with the level Unlimited and the account type PaymentService are fully functional accounts.

Swan accounts have different capabilities determined by the combination of these values.

| Level + Type | Capabilities |

|---|---|

Limited + EMoney | ✓ The account can be used for certain actions, such as inviting account members and adding virtual cards. ☒ Account holder verification isn't complete. ☒ The account's main IBAN isn't displayed. ☒ Payments can't be made from the account. |

Limited + PaymentService | ✓ The account's main IBAN is displayed. ✓ Money can be added to the account. ☒ Account holder verification isn't complete. ☒ Payments can't be made from the account. |

Unlimited + PaymentService | ✓ Account holder verification status is Verified.✓ Payments can be made from the account. ✓ The account's main IBAN is displayed. ✓ All accounts functions are possible. |

Balances

Accounts at Swan are designed for credit balances only.

Swan account balances can never go below zero, meaning Swan rejects outgoing payments if the account's Available balance isn't sufficient to cover the total payment amount.

The only exception is the automatic billing of banking fees.

There are four different account balances.

| Balance | Includes | Equal to |

|---|---|---|

Booked | Transactions that are already debited or credited | Sum of all Booked transactions |

Pending | Transactions that were authorized but haven't been debited or credited yet | Sum of all Pending transactions |

Reserved | Transactions that require rolling reserve according to the policy for that payment methodReserved amount is included in the Booked balance | Sum of all Booked transactions for which the funds are still in rolling reserve |

Available | Balance that is actually available to be used | Booked + Pending - Reserved. Currently, Pending is always negative, while Reserved is always positive. |

Example: Insufficient funds

This example involves the balances Booked, Pending, and Available.

- An account has a

Bookedbalance of 142€. - There is a

Pendingoutgoing transfer request for 42€ that is still being processed. Therefore, theAvailablebalance is 100€ (142€ - 42€ = 100€). - This account doesn't have a sufficient balance to send an outgoing payment of more than its 100€

Availablebalance. Therefore, the payment is rejected.

Example: Rolling reserve

This example involves the balances Booked, Reserved, and Available.

- A merchant's account has a

Bookedbalance of 200€ thanks to accepting a customer's payment through SEPA Direct Debit. - For this example, the rolling reserve is 15% over 15 business days (exact rolling reserve amounts can change based on your contract with Swan). Therefore, the

Reservedbalance is 30€ for 15 days. - The

Availablebalance from this transaction is 170€ for the duration of the rolling reserve period (200€ - 30€ = 170€). - After 15 days, the

Reservedbalance is released and the fullAvailablebalance is 200€.

Transactions

An account is essentially a list of transactions, and transactions directly impact account balances.

There are six possible statuses for Swan transactions. Each payment method uses a different combination of these statuses with specific flows. Refer to the schemas for credit transfers, direct debits, and cards for more information about statuses for that payment method.

| Transaction status | Explanation |

|---|---|

Upcoming | Transaction was initiated and consent was granted, but the transaction isn't executed yet. Upcoming transactions don't impact the account balance. |

Pending | Transaction was initiated, consent was granted, and the transaction is set to happen within a few days. The transactions aren't debited from the account yet, but they impact the account's Pending balance. |

Booked | Completed transactions that are displayed on the official account statement. These transactions have been debited from the account, and they impact the account's Booked balance. |

Released | Unique to card transactions, card authorizations might be released for specific reasons. Released transactions can impact the account balance. Refer to the card payments section for more information. |

Canceled | An Upcoming transaction is canceled by someone with the right to do so, such as the account holder, an account member, or a merchant. Only transactions with the status Upcoming can be Canceled, and Canceled transactions don't impact the account balance. |

Rejected | Declined or refused transactions. For example, the beneficiary account might be closed, or the account's Available balance isn't sufficient to complete the transaction without resulting in a negative balance. |

Account documents

Account statements

Each month, Swan generates account statements automatically for all Swan accounts using Coordinated Universal Time +1 (UTC +1).

Statements include all Booked transactions from the previous month.

Access account statements with the API by calling the account query and adding the statement object.

They're also available from your Dashboard > Data > Accounts, and, if you're using it, Swan's Web Banking interface.

Account statements are available in .pdf or .csv format by default.

Statements with more than 50,000 transactions are generated as .csv files, even if you request .pdf.

All account statements have a period attribute.

- If

period=Monthly, Swan generated the statement. - If

period=Custom, the statement was generated following your request.

Generating statements

You can generate account statements for a period of up to three months with the generateAccountStatement mutation.

These statements always have period = Custom.

If you generate two statements with identical parameters (language, openingDate, closingDate), Swan only generates one statement.

For the second statement, Swan provides the link to the first statement generated.

If the language parameter changes, however, a new statement is generated in the updated language.

Producing custom statements

You can also access the raw data and produce custom statements.

For example, you might:

- Need a provide a format Swan doesn't support.

- Want to customize the style.

- Prefer to use a different timezone than Central European [Summer] Time (CET/CEST).

Note that even if you use custom statements, Swan generates statements each month. If audited, Swan's account statement is the official version.

As a regulated financial institution, account statements fall under compliance rules. You might need to get your custom statements approved. Please work with your dedicated Technical Account Manager before releasing a custom account statement.

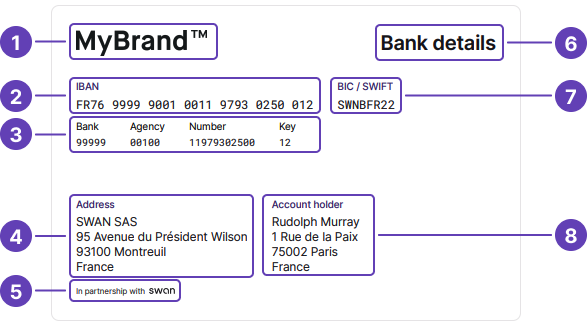

Bank details document

You can get a PDF with your bank details using the API and from Swan's interfaces. Bank details are available for main and virtual IBANs. In French, this document is called a RIB, or a relevé d'identité bancaire.

The PDF is generated automatically after the account's main IBAN is assigned, meaning the account must have the payment level Unlimited and the account type PaymentService.

Refer to the account type and level section for more information about these values.

Note that the automatic generation might take a few minutes. The document is generated in the account language. If an account's bank details document wasn't generated automatically, call the API to generate it.

Bank details documents include:

- Your logo.

- Account's main IBAN.

- Bank code.

- Your company's information.

- Disclaimer: "In partnership with Swan".

The Swan partnership disclaimer is required because Swan assumes responsibility for all sensitive banking operations. It's similar to the statement printed on physical cards indicating that cards are issued by Swan.

- Title of the document.

- BIC/SWIFT code.

- Account holder's information.

Transaction statements

Your users might need to provide a document to a third party confirming they initiated a transaction. Transaction statements, also referred to as transaction confirmations, demonstrate that the transaction was executed by Swan. However, these statements don't provide proof that a transaction was completed successfully; the beneficiary's bank can reject a transaction after Swan executes it.

Refer to the transactions section for more information.

Account statuses

| Status | Explanation |

|---|---|

Opened | Account is open and can be used |

Suspended | Swan can suspend an account if there's suspicion of fraud. While suspended, the account can't be used. This results in the following events: 1. All card payments are Rejected. 2. SEPA Credit Transfers: ◦ Incoming Credit Transfers are Accepted. ◦ Outgoing Credit Transfers are Rejected. 3. SEPA Direct Debits (SDD): ◦ Incoming SDDs are Booked. ◦ Outgoing SDDs are Rejected or Returned on the scheduled date. 4. Funds available in the account can't be used while Swan reviews the suspension. 5. Some previously authorized transactions are Booked. 6. For merchant accounts: received French check payments are Returned. |

Closing | While an account is closing, the following events occur:

Closing until:

|

Closed | For all Closed accounts, access and account statements remain available for one year through the API or with Swan's Web Banking interface. |

As long as the Booked balance doesn't equal zero:

- The account status can't pass from

ClosingtoClosed. - The account holder can still log into their Swan Web Banking interface.

- The account holder can send SEPA Credit Transfers.

If funds remain in a Closing account after 10 years, Swan transfers the funds to France's Caisse des dépôts et consignations (Deposits and Consignments Fund).